Assessing innovation risk (H5) 2)

The Father of Modern Management, the late Peter Drucker, discovered that, rather than possessing an "entrepreneurial personality," successful innovators, nevertheless, share a common trait: they are not risk-takers. He also postulated seven sources of innovative opportunity that can be exploited systematically, with new knowledge being the most risky to exploit [1]:-

Unexpected successes and failures

Incongruities

Process needs

Changes in sector structures

Changes in demographics

Changes in meaning and perception

New knowledge

My handwritten notes made 40 years ago:-

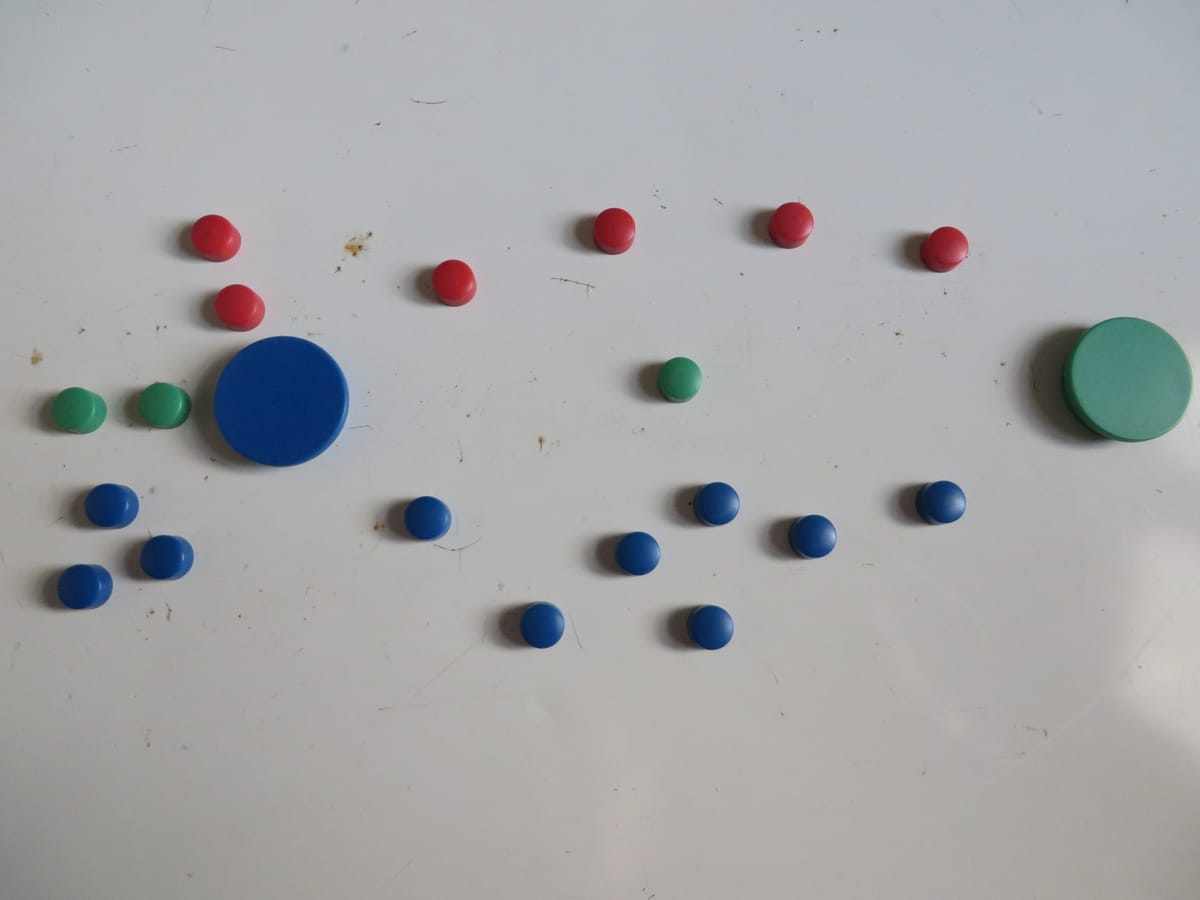

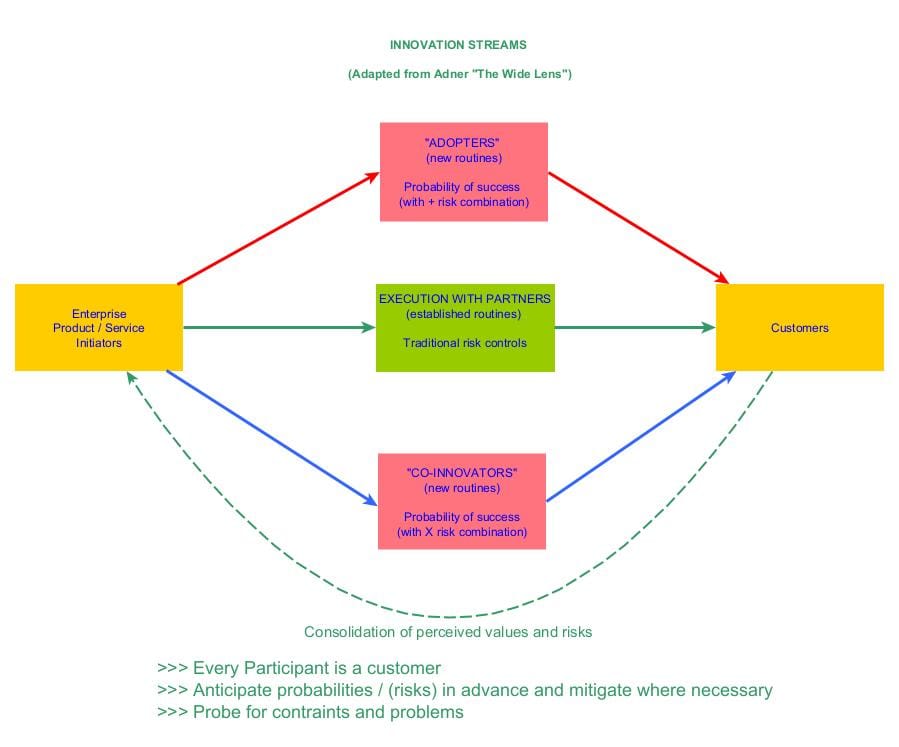

However, success is no longer solely tied to execution competencies within the enterprise following known routines, shown green in the magnets above and the diagram following. When new routines are required, it is also vital to consider interdependence between value network participants - channel partners and suppliers for example - shown red in the diagram. Mastering interdependence principles leads to significant gains, while neglecting them and the attendant risks results in inefficiencies, disappointments, and ultimate failure [2]. The majority of innovations that erroneously follow the green pathway fail if co-innovation is involved. Further, if the risks attendant to adoption are unrecognized, a similar unfortunate result is likely. This wider viewpoint requires strategists to develop a clearer view of the full set of dependencies rather than simply the immediate innovation environment using established routines.

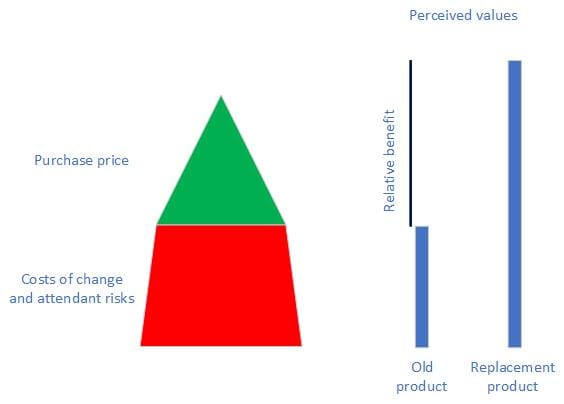

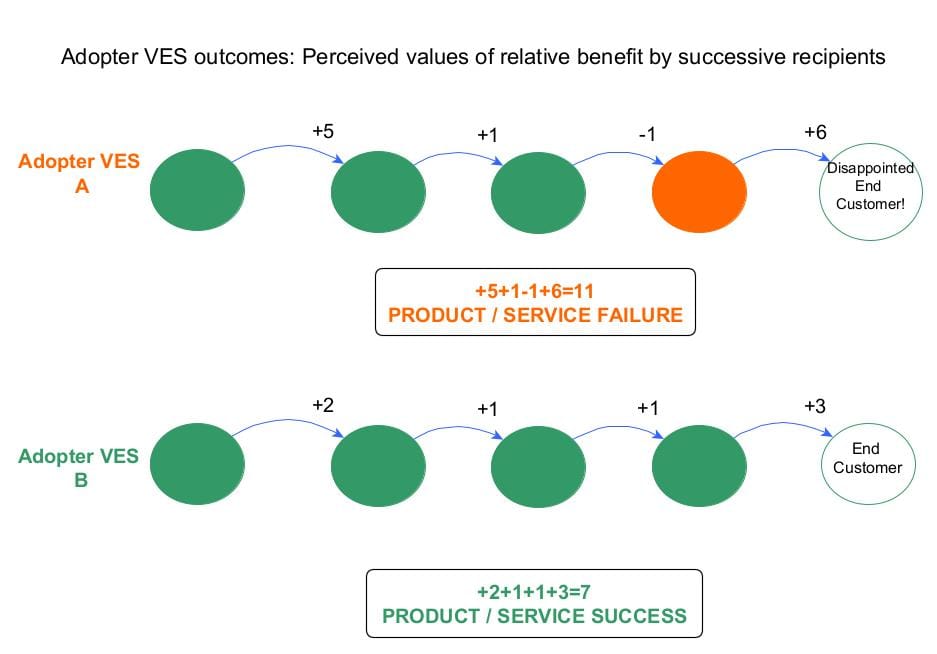

In Adopter VES risk, the key question is: who else needs to adopt my innovation before the end customer can assess the full value proposition? This implies that everyone in the Value Exchange System chain is a customer. For their purchase decision, each in turn will need to ask themselves whether the perceived value for them is high enough. Is the relative benefit of the innovation they are invited to convey worth the combination of the price they have to pay and the hidden costs and risks associated with doing so.

This applies whether or not the original sender feels their innovation will be of value. For example, if any enterprise, shown orange in the diagram, is unwilling to accept the Deliverable, the Adopter VES will be broken. The disappointed end customer in the potential served market won't then have the chance to fully assess the value of the proposition as perceived by the originating Participant. The innovation has failed.

This applies even if the combined sum of the perceived values is greater than that occurring in a successful Adopter VES, shown as B.

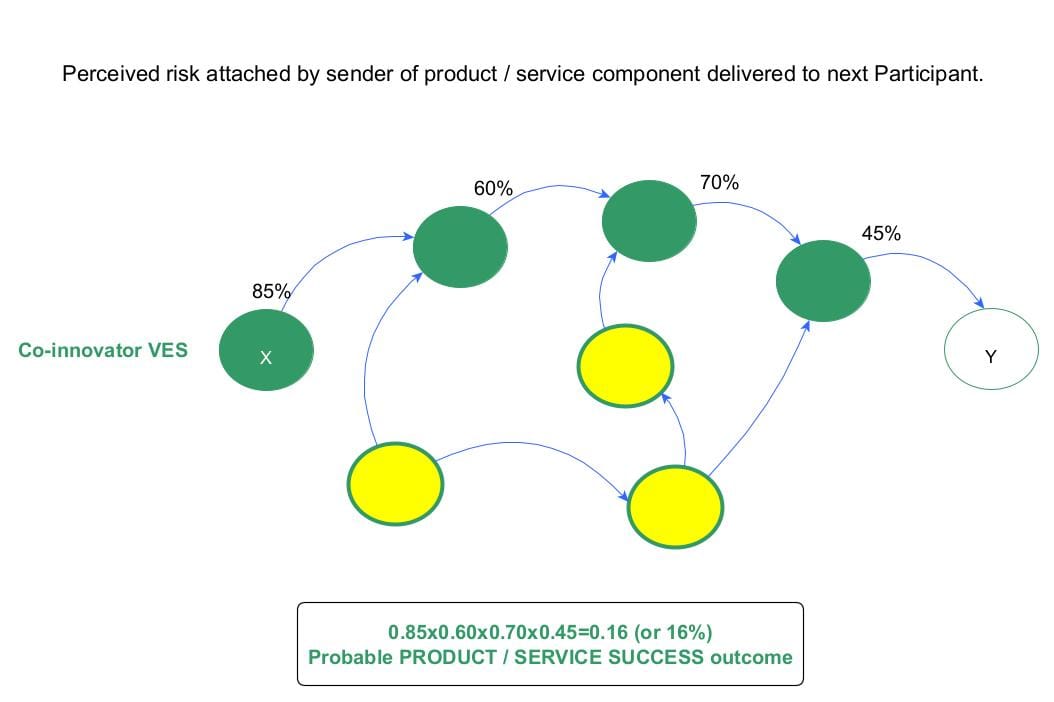

In Co-innovator VES risk, the key question is: who else needs to innovate for my innovation to matter? In other words: "How much does your innovation's successful commercialization at X rely on the successful commercialization of component innovations by Co-Participants before reaching the ultimate customer at Y? See diagram below.

Consider first a simple value chain configuration of Co-Innovators shown in solid green. Clearly, every Participant will feel that their innovation will have a probability of success otherwise they would not be participating. The combination of individual probabilities of success must now be appraised.

The rule is: if two activities, both of which have a probability of success of 90%, are connected, the combined probability of success is 90% of 90%, which is 0.9x0.9 = 0.81 or 81%.

Applying this to the example below, we find the overall probability of success is 16%. This may be considered poor, but is compatible with industry norms, and may well be worth the bet. The trouble begins when we make a 16% bet but think the odds are 85%. [2]

When adding in the remainder of the Participants show yellow below to complete the Value Exchange System (in this case a value network ), the odds against success inevitably will be increased further.

The Value Blueprint

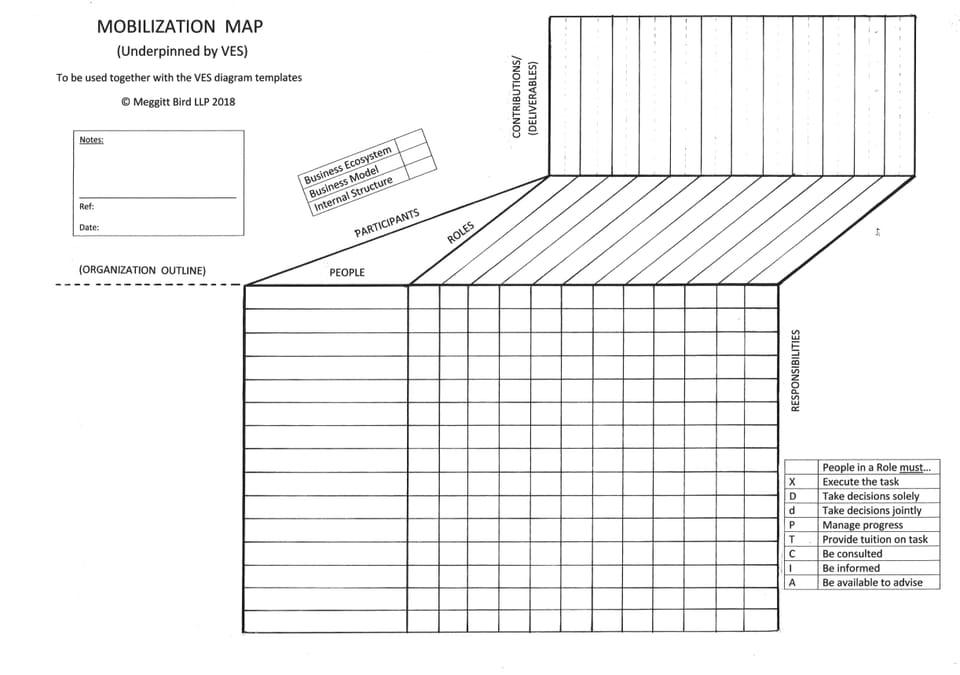

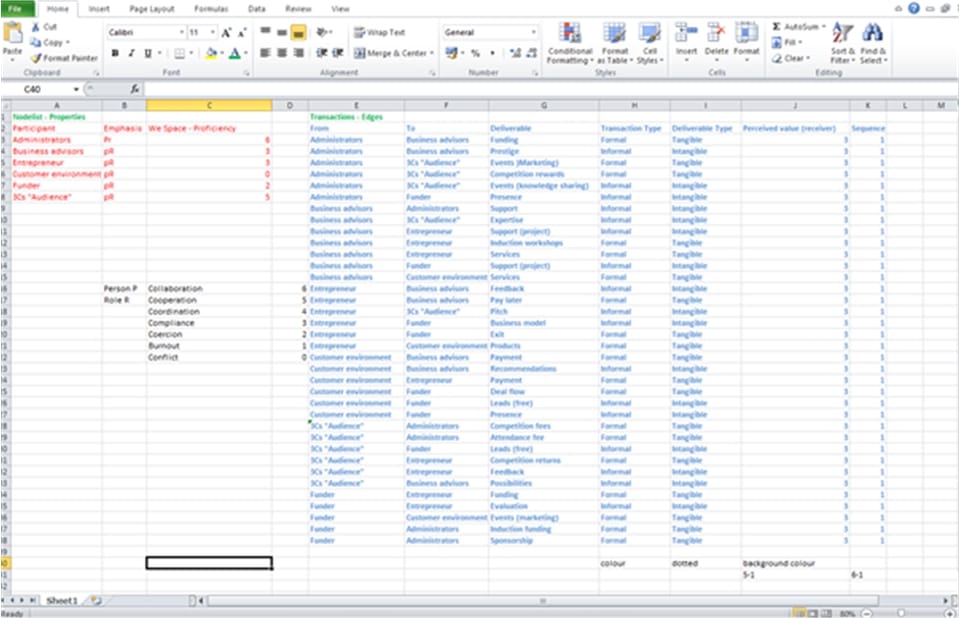

The idealised descriptions so far need to be made practical and the key source [2] strongly recommends creating a value blueprint. The commonly used term "value proposition" simply acts as a guiding promise, articulating the envisioned new value stemming from innovative efforts and specifying the intended beneficiaries.

To translate this promise into effective action, a strategic approach is essential and a value blueprint is proposed. Unlike conventional supply or value chains that highlight linear sequences, the value blueprint emphasizes the specific roles and the connections of all complementors in a value exchange system. These pivotal partners are crucial for success and often overlooked by the initiating innovator X. The blueprint:-

Forces all involved parties to confront challenges beyond their immediate roles. (Ownership is secondary; what matters most are the Roles being played, and Participant contributions, even when they originate from the same entity.)

Fosters proactive collaboration and risk management.

Clarifies the value network configuration and encourages holistic thinking.

Highlights where the most significant risks may lie.

An interesting outcome from the above is that the blueprint can divert a Participant's attention from prioritising the reduction of risk in its own innovation efforts to enhancing the probability of success of a Co-innovator's, should the overall effect be more beneficial.

To construct a value blueprint, start by following the steps used to create a VES diagram, and distinguish between the Adopter and Co-innovator value exchanges. Then for every combination of Participant and Deliverable ask the following questions:-

What is the level of risk this Participant presents?

How willing (for Adopters) and able (for Co-innovators) are they to undertake the required activities within their respective Role or Roles?

For practical purposes, a traffic light continuum - green, yellow, red - is suggested to characterize the risk status of each Deliverable as recommended in [2].

Summary

1) Recognize the existence of three separate but interlinked innovation streams.

2) A 16% innovation success rate is the norm.

3) Use VES to illuminate the value blueprint and elevate your success rate.

Refs.

[1] P. Drucker, Innovation and Entrepreneurship, 1985.

[2] R. Adner, The Wide Lens - a new strategy for innovation, London: Portfolio Penguin, 2012.